Checking worth "Checking Into"!

Ready to make the break from high banking fees? At Erie FCU, you’ll love our checking options! Our FREE Checking is really free with absolutely "no strings" attached and our Dividend +Plus Checking can earn you money monthly! Both come with free mobile banking, "contactless" debit cards, and Mobile Deposit.

Make the switch and we’ll have you banking happily ever after!

Free Checking that's really FREE! (For real. We're not kidding)

You'll love our "no strings" FREE Checking! Get the peace of mind your busy lifestyle needs! No "gotchas" or surprises | no hidden fees. Enjoy great

checking with the same bells and whistles as the big banks.

- No minimum daily balance

- No monthly maintenance fee

- Free Mobile Deposit for iPhone & Android

-

Free Checking is just that - FREE, regardless of your balance, or other credit union services you use.

Dividend +Plus* Checking earns you money monthly!

Like earning money with your checking? Who doesn't...right? Our Dividend +Plus Checking earns you 2.02% APY monthly for doing many of the things you are already do! Earn better thank bank rates each and every month!

Earn more than average - because you’re more than average!

See if Dividend +Plus Checking is right for you!

Erie FCU Contactless Debit Card. Click to learn more!

Enjoy with both Checking Options

- FREE 24/7 account access with Mobile and Online Banking

- FREE "contactless" Debit Card Mastercard®. Digital Wallet payments available too - Apple Pay, Samsung Pay, Garmin Pay, Google Pay (Fitbit pay).

- Local ATM locations with 38,000 ATMs shared nationally.

- Overdraft protection and more!

Which Checking Option Works Best For You?

Checking Comparison Chart

| Benefits |

Dividend +Plus Checking |

Premium Checking |

Free Checking |

| Earns Interest |

Yes |

Yes |

No |

| Minimum Balance Requirement |

No |

No |

No |

| Minimum Average Daily Balance Required to Earn Higher Dividend |

$500.00 |

No |

No |

| Free Basic Credit Union Checks Limit 2 boxes per primary members SSN# per year |

1 box with Direct Deposit of Net Pay2 Boxes with Social Security or Pension Direct Deposit |

1 box with Direct Deposit of Net Pay2 Boxes with Social Security or Pension Direct Deposit |

1 box with Direct Deposit of Net Pay2 Boxes with Social Security or Pension Direct Deposit |

| Monthly Service Fee |

A $2 per month fee if monthly requirements are not met |

Yes $2 per month |

No |

| Additional Monthly Requirement |

EZ e-Statements, Min. of 1 EZ Bill Payment posted & Min. of $250.00 in PIN and/or Signature Debit Card purchases posted each calendar month. (ATM transactions do not apply) |

No |

No |

| Overdraft Protection Options |

Yes |

Yes |

Yes |

| Nationwide Shared Branch Access(SM) |

Yes |

Yes |

Yes |

| Monthly Statement/ Paper or e-Statement |

Yes |

Yes |

Yes |

| Free 24/7 Account Access EZ Money Manager EZ Phone, EZ Mobile EZ Alerts, EZ Bill Pay |

Yes |

Yes |

Yes |

| Free Debit MasterCard® TransactionsPin/Signature/ATM |

Yes/15 PIN or Signature transactions per day |

Yes/15 PIN or Signature transactions per day |

Yes/15 PIN or Signature transactions per day |

| Free Erie FCU ATM Withdrawals/Inquiries |

Yes/$400 withdrawal limit per day |

Yes/$400 withdrawal limit per day |

Yes/$400 withdrawal limit per day |

| Free Erie FCU ATM Deposits |

Yes/Unlimited |

Yes/Unlimited |

Yes/Unlimited |

| Non-Erie FCU ATM Withdrawals |

4 free per month- $1.50 fee per withdrawal after 4 |

4 free per month- $1.50 fee per withdrawal after 4 |

$1.50 fee per withdrawal |

| Non-Erie FCU ATM Inquiries |

$.75 per inquiry |

$.75 per inquiry |

$.75 per inquiry |

Ready to make the switch?

Switching your checking account shouldn't be a hassle. We'll assist you in changing your automatic payments, transfers and direct deposits to your Erie FCU Checking Account.

*When requesting information regarding a product or service via email, please do not include any personal or sensitive account information.

Learn about our High Dividend Yielding Checking Account

Debit Card RoundUp with EZ Saver!

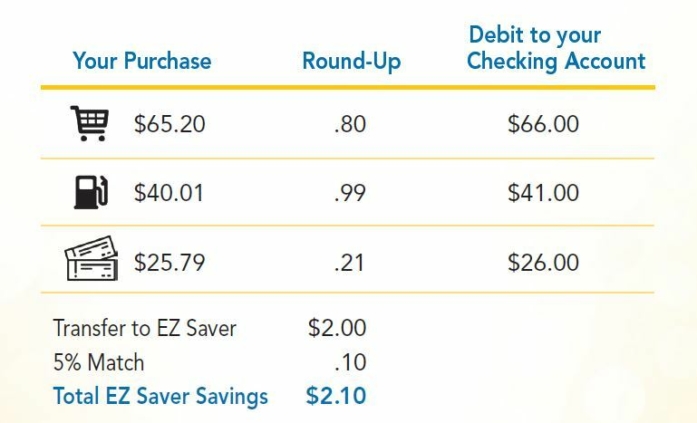

Saving has never been so easy!! Every time you make a purchase with your Erie FCU Debit Card, the transaction will automatically be rounded up to the next full dollar amount with EZ Saver. At the end of each business day, the accumulated round-up amount from each of the transactions will be transferred from the checking account attached to your debit card to an EZ Saver Savings Account.

*As an added benefit, we’ll match 5% of your daily round-up amount to your EZ Saver Account at the end of each month in the first 30 day.

Open an EZ Saver Account today & receive a 50% match for the first 30 days.

*The credit union will match 50% of the daily round up transfer amounts posted to the EZ Saver Savings Account in the first 30 days (after the initial qualifying debit card transaction is posted to your checking account after enrollment). After the 30 day period, credit union will match 5% of the daily round up transfer amounts posted to the EZ Saver Savings Account. No minimum balance required. Withdrawals from your EZ Saver Account, before the end of the calendar month, will affect earnings. Annual Match limit is $300. Matching amounts are not dividends and will not be reported to the IRS on Form 1099-INT. One EZ Saver Account per member. Member must enroll in EZ e-Statements, have an Erie FCU checking account and Debit Mastercard. Not available with Business Checking Accounts. Certain restriction apply and subject to change. Contact credit union for complete details.

A Dividend +Plus Checking Account Makes Sense For You!

Feel like your current checking account isn’t returning the favor? Open a Dividend +Plus Checking Account today and start earning dividends. It's easy, we'll show you how.

Learn more about Dividend Plus Checking

Erie FCU Contactless Debit Card. Click to learn more!

Debit Mastercard®

Worldwide access to your Checking Account.

- Point-of-sale purchases

- ATM Access

- ATM Locations

- Balance Inquiries

- Deposits

- Withdrawals

- Experience a faster and more secure way to pay with your contactless Erie FCU debit card!

- Digital Wallets like Apple and Samsung Pay available too!

How to Manage Your Erie FCU Debit Card

Go Direct With Direct Deposit

Direct deposit is the best way to receive your Social Security, SSI, VA Compensation, Pension and Payroll. Direct Deposit allows immediate access to funds, eliminates the risk of stolen checks and reduces your exposure to fraud.

To learn more about the benefits of Direct Deposit log on to www.directdeposits.org or contact your employer to request Direct Deposit.

Click here if you need to download and print one of our Direct Deposit Forms.

How Do I Set Up Direct Deposit?

Processes for signing up can differ by employer, but at the very least you will need your nine-digit account number (provided at account opening, viewable on checks you have for your Erie FCU account, or on your statement) and Erie FCU’s Routing and Transit Number—sometimes just called “routing number” or “ABA number”.

The Erie FCU routing number is 243380927

Some employers provide us a copy of their forms.

Need Help?

If you need help, connect with us at any branch office or call 814-825-2436.

Account Overdraft: Guard against the cost of accidental overdrafts

- Link your checking account to one of your savings accounts

- Transfers in $50.00 increments

Click here to view current overdraft option fees.